Here is an awesome youth online research study we conducted with Doughmain, a free financial education and family organization platform. The topic of the study was “Chores & Allowance and the 21st Century Kid”. Check out the press release and infographic below.

Source: https://www.doughmain.com/wordpress

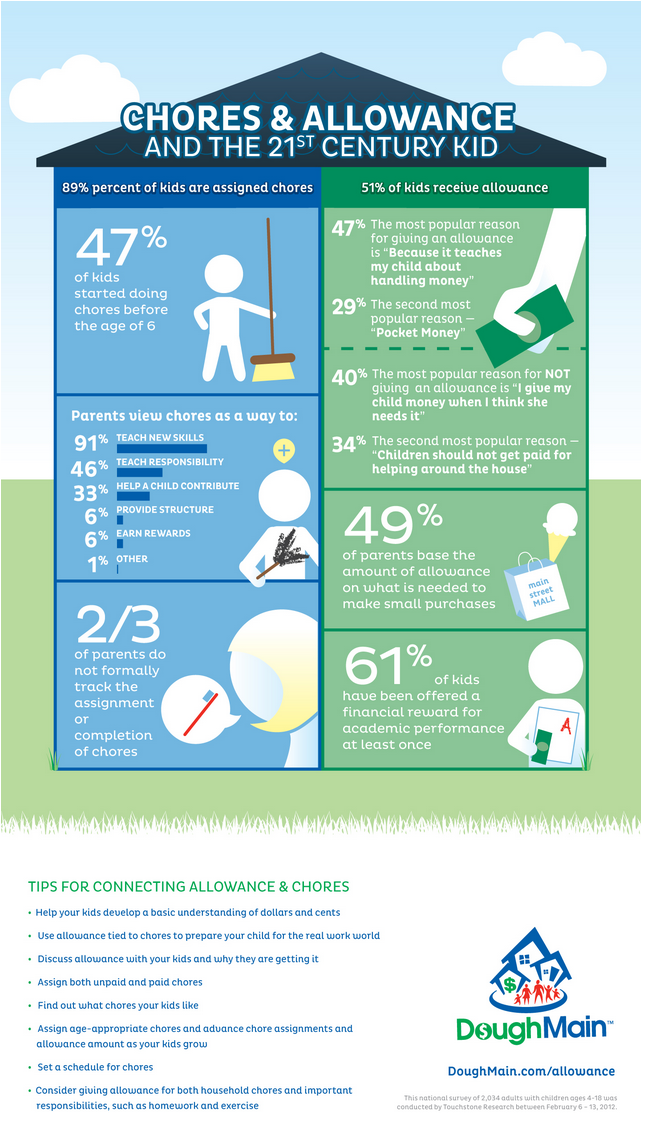

One of the most frequently discussed topics among today’s parents is whether they should assign their kids chores, and whether they should give allowance or rewards as an added incentive to help expose them to the concept of money. The results of a recent national survey asking more than 2,000 parents how they teach their kids to interact with money in their daily lives highlights that parents are still split on the topic. In the study titled, “Chores & Allowance and the 21st Century Kid,” conducted by DoughMain, a free financial education and family organization platform, an overwhelming 89 percent of parents revealed they assign chores and 51 percent give an allowance — but only 21 percent of those parents that provide allowance said the primary reason for allowance was recognition for chores. An additional 47 percent indicated that they provide allowance as a way to teach their kids how to handle money, but not in connection with chores. The study also revealed that non-monetary rewards for the completion of chores, such as additional computer or television privileges, is on the rise, with 26 percent of parents stating they give those instead of a monetary allowance.

“Over the past few months, the ‘Great Allowance Debate’ has been raging, with many financial experts weighing in on whether giving an allowance helps make kids smarter about money — and whether parents should require kids to do chores to receive one. While there are varied opinions, our research clearly exposes that parents recognize the opportunity to use allowance as a way to teach real-life financial literacy and that assigning chores helps teach their kids responsibility,” said Ken Damato, president and chief executive officer of DoughMain. “But we believe many parents are missing a critical opportunity by connecting the two into one powerful chores and allowance system. For many children, allowance is their only form of income, and we think when connected to chores, this type of responsibility is also instrumental in learning good financial management.”

Damato continued, “When that light bulb goes on for a young child who suddenly grasps that a job well done is connected to an ability to earn and save money for personal gain, gift giving or charitable efforts, we have begun to develop a more financially responsible next generation. That’s a win-win for both parents and kids.”

- 47% of families that provide allowance do so to teach their children about handling money. Other popular reasons were to provide “pocket money” (29%) or as a reward for doing chores (21%)

- For those families that do not provide a formal allowance, the most common reason was that parents give their children money when they think the kids need it (40%). Other popular reasons were the belief that children should contribute around the house without being paid for it (34%) and the use of non-monetary rewards (18%)

- If you are a child in a family that provides allowance, chances are (49%) that you started receiving it before you turned 7 years old

- 49% of the families that provide allowance base the amount of the allowance on what is needed to make small, age-relevant purchases

- 61% of parents have, at least once, offered a financial reward for academic performance

- Of the 89% of families that assign chores to the children, the following were commonly cited reasons:

- A way to teach household and personal skills (91%)

- A way to teach responsibility (46%)

- A way to contribute to the household (33%)

- A way to provide structure (6%)

- An opportunity to earn money (6%)

- Chores come earlier than allowance with 72% of kids are doing chores by the age of 7

- Only 29% of families use some kind of formal system to track chores (like a chore chart or written list). Most parents (69%) just verbally tell their kids what chores to do

To continue to help families have a productive discussion about allowance (income) and chores (responsibility), and in honor of April’s National Financial Literacy Month, DoughMain has created the Family Financial Pledge, encouraging parents across the country to pledge to actively teach financial education on a daily basis at home. On March 31, 2011, President Obama delivered a Presidential Proclamation declaring April as National Financial Literacy Month. The month is an annual opportunity for Americans to recommit to building a secure future for themselves and their families and to improving financial literacy, ensuring that all Americans have access to trustworthy financial services and products.

DoughMain offers the following tips for parents to connect allowance and chores as tools to help teach kids about money matters:

- Use allowance as a teaching tool, but give it with expectations or tied to chores rather than with “no strings attached” — this better prepares your child for the real work world!

- Be sure to discuss allowance with your kids, such as why they are getting it, how they should budget it and when to save, spend or share, etc.

- Before assigning allowance, make sure your kids know the basics of coin recognition and confirm they have a basic understanding of keeping track of dollars and cents

- Assign some chores as unpaid to help teach responsibility, and others as paid tasks tied to allowance

- Find out what chores your kids like and assign chores that are age-appropriate. Consider advancing both chore assignments and the associated allowance amount as your kids get older

- Set a schedule for chores and communicate expectations

- Consider giving allowance or rewards for household chores like dusting and vacuuming, but also for important responsibilities, such as homework, hygiene, exercise, punctuality and positive behavior

DoughMain’s study was conducted by Touchstone Research between February 6 – 13, 2012. DoughMain’s innovative gaming platforms and tools encourage learning about finances through interactive play, making the process fun and engaging for both parents and children. DoughMain’s unique online chore chart tied to an allowance/rewards program teaches kids about the fundamentals of money management in a relevant, digital way for today’s generation. For more ideas and tools to help teach kids about money matters through real-world experiences, visit DoughMain.com.

About DoughMain

DoughMain is the first and only service to combine family coordination and financial education into one simple and convenient platform. Helping families manage their lives while empowering them to become better educated about money, DoughMain offers a suite of on- and off-line services, including an integrated family calendar, chore tracker, allowance/rewards tool and three age-relevant gaming websites: TheFunVault.com (ages 5 and up), SandDollarCity.com (ages 8- 12) andIRuleMoney.com (ages 13-18). To learn more about DoughMain, please visit DoughMain.com or follow the company on Twitter @DoughMainBuzz and Facebook at facebook.com/DoughMainBuzz.